9 Simple Techniques For Estate Planning Attorney

Wiki Article

Some Known Questions About Estate Planning Attorney.

Table of ContentsThe Of Estate Planning Attorney7 Simple Techniques For Estate Planning AttorneyEstate Planning Attorney Can Be Fun For EveryoneSome Known Incorrect Statements About Estate Planning Attorney

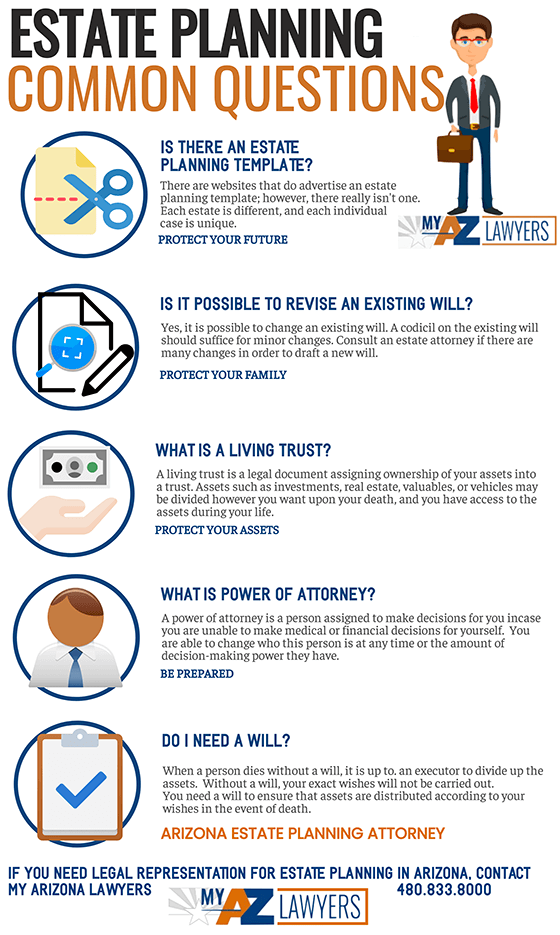

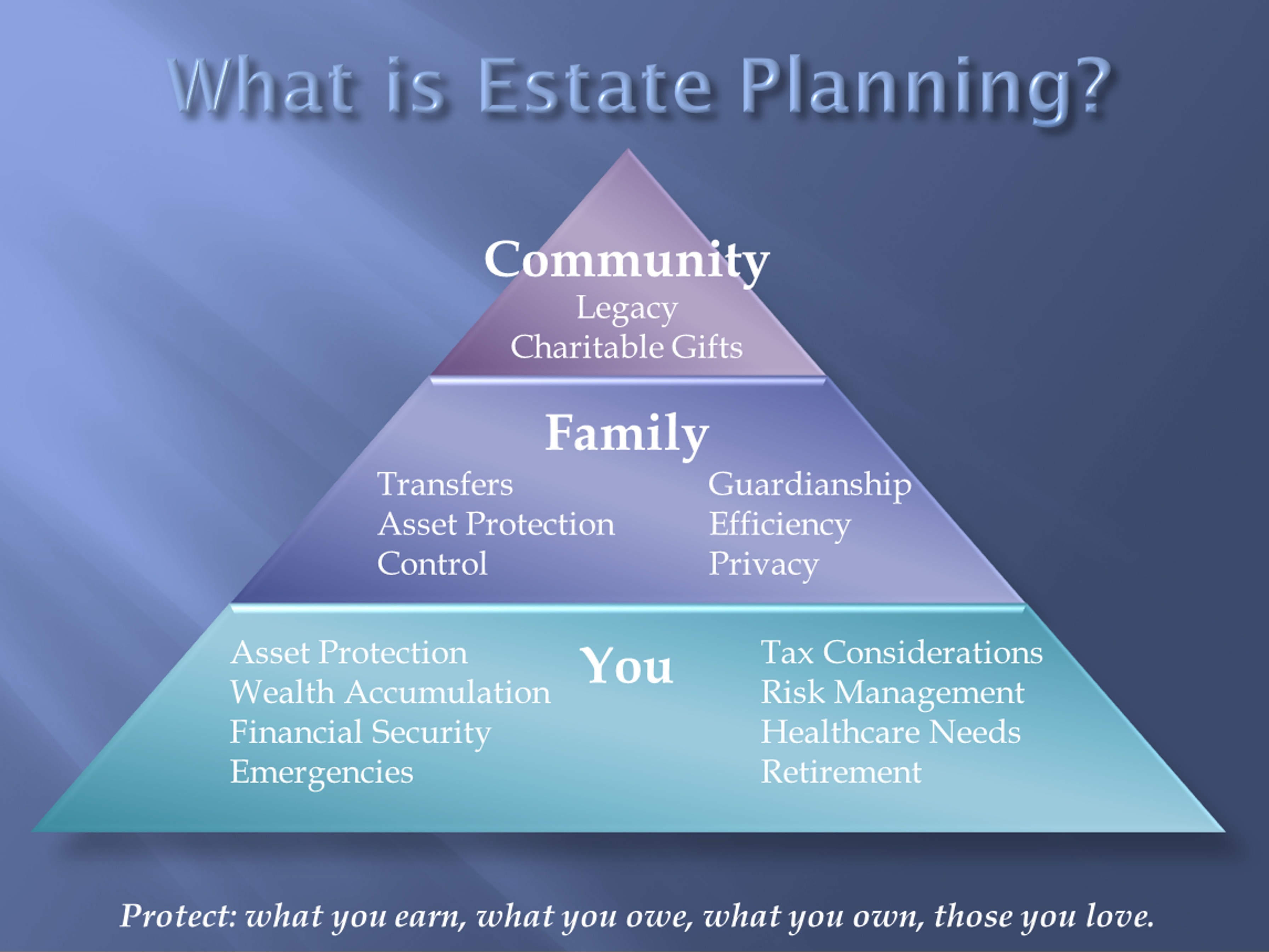

Estate preparation is about making sure your household recognizes exactly how you want your assets and affairs to be handled in the event of your fatality or incapacitation. That's where estate preparation lawyers come in.

It's vital to deal with a lawyer or law company experienced in estate regulation, state and government tax planning, and depend on administration - Estate Planning Attorney. Otherwise, your estate plan might have gaps or oversights. Ask pals, family, or colleagues for recommendations. You may also ask your company if they offer a lawful plan advantage, which could link you with a network of experienced estate planning attorneys for a low month-to-month fee.

Having conversations with the people you love regarding your very own passing away can really feel uneasy. The structure of your estate plan starts by believing with these hard scenarios.

The 6-Minute Rule for Estate Planning Attorney

Whether you're simply starting the estate planning process or desire to modify an existing plan, an estate planning attorney can be a vital resource. Estate Planning Attorney. You might think about asking close friends and associates for recommendations. Nonetheless, you can likewise ask your employer if they use lawful plan advantages, which can help attach you with a network of experienced lawyers for your legal demands, consisting of estate planning.

Estate planning attorneys are valuable throughout the estate preparation procedure and later on with the procedure of probate court. They recognize the state and federal regulations that will certainly influence your estate.

Not known Facts About Estate Planning Attorney

A good estate preparation attorney may be able to aid you prevent probate court entirely, but that mainly depends on the over here type of properties in the deceased's estate and exactly how they are legally permitted to be transferred. In the event that a beneficiary (or perhaps a specific not designated as a beneficiary) announces that he or she intends to dispute the will and sue the estate of a departed relative or liked one that you also stand to gain from, it may be in your benefit to seek advice from an estate planning attorney immediately.

Normal attorney really feels often vary from $250 - $350/hour, according to NOLO.1 The much more difficult your estate, the more it will certainly set you back to set up. If you would certainly such as more information on wills and estate planning, see the Safety Knowing. 1. INTERNET.1448.05.15.

An Unbiased View of Estate Planning Attorney

They will certainly advise you on the most effective legal alternatives and files to safeguard your assets. A living depend on is a legal document that can address your desires while you're still active. If you have a living count on, Get More Info you can bestow your properties to your enjoyed ones during your life time; they just don't get accessibility to it up until you pass.You might have a Living Trust drafted during your lifetime that provides $100,000 to your child, however only if she graduates from university. There are some records that go right into impact after your fatality (EX-SPOUSE: Last Will and Testimony), and others that you can utilize for clever property monitoring while you are still great post to read active (EX LOVER: health care directives).

As opposed to leaving your household participants to presume (or suggest), you ought to make your objectives clear now by working with an estate planning lawyer. Your attorney will certainly aid you draft healthcare instructions and powers of attorney that fit your way of life, possessions, and future goals. One of the most typical method of avoiding probate and inheritance tax is via making use of Trusts.

If you carefully plan your estate now, you might be able to stop your successors from being pushed into lengthy lawful battles, the court system, and adversarial family disagreements. You desire your beneficiaries to have an easy time with preparation and legal problems after your fatality. A properly implemented collection of estate strategies will conserve your household time, money, and a lot of stress and anxiety.

Report this wiki page